40 credit shelter trust diagram

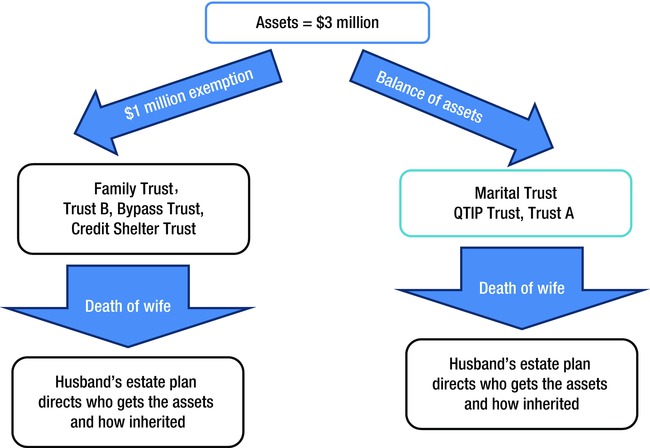

Hw the AB Trust Works (Via Diagram) ... The "B Trust" is referred to as the "Bypass Trust," "Credit Shelter Trust," or "Family Trust." The "A Trust" contains the property of the surviving spouse, and the B trust will contain the deceased spouse's property. The limited control the surviving spouse has will allow him or her ...

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse. The assets held in the CST can benefit the surviving spouse during their lifetime. Credit shelter trusts are also commonly known as bypass, family, or exemption trusts.

“QTIP” (Qualified Terminable Interest Property) and “Credit Shelter” trusts, two common ways of reducing estate tax and avoiding probate, allow an estate to be placed in trust for the use of the surviving spouse for life with the balance passing to beneficiaries, usually children, upon the spouse’s later death.

Credit shelter trust diagram

A bypass trust (also referred to as a credit shelter trust or a tax exemption trust) is an estate planning tool commonly used in trust designs referred to as "AB Trusts" or "ABC Trusts." In these trust designs the "A" trust (also referred to as a surviving spouse's trust or survivor's trust) grants the surviving spouse full ...

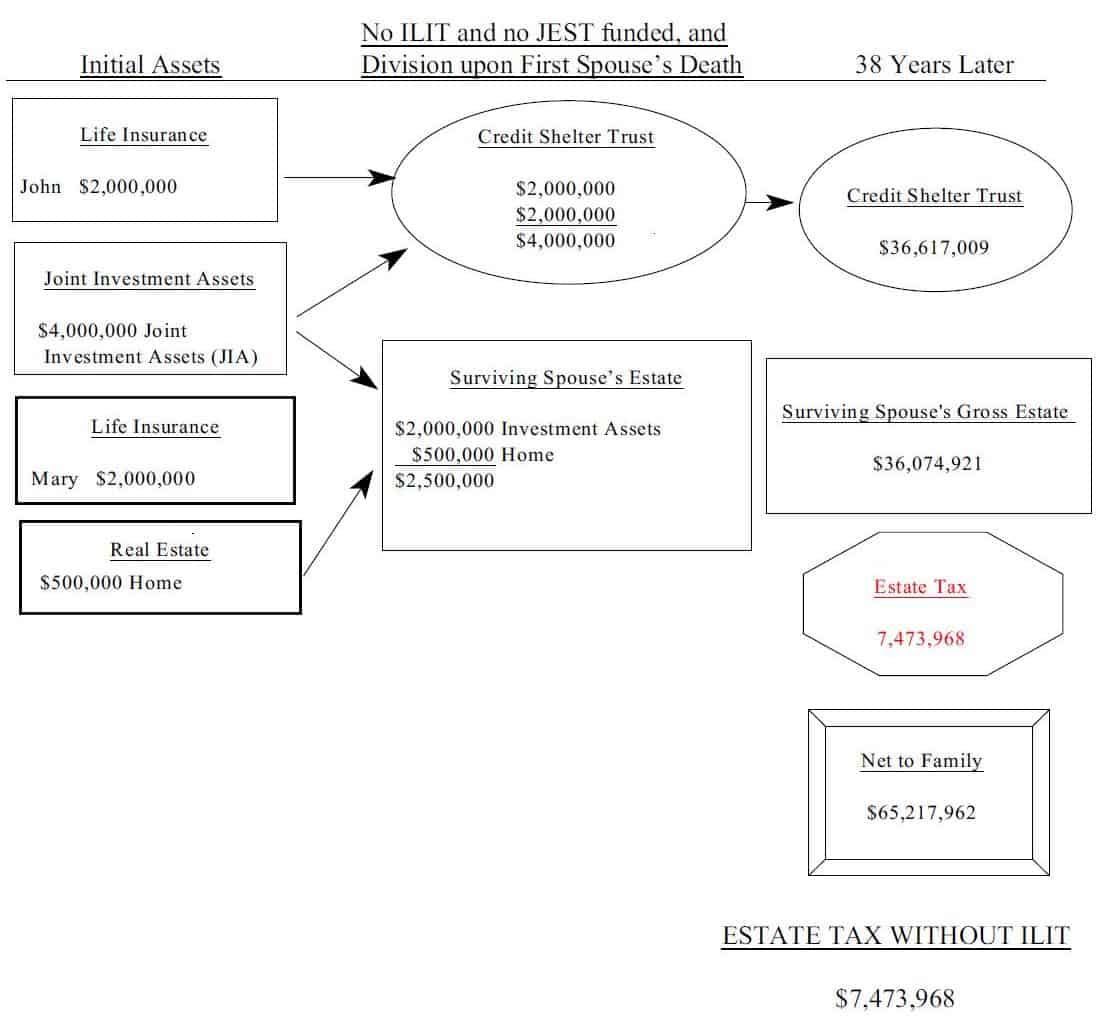

A bypass trust (also called an "A/B trust" or a "credit shelter trust") was designed to prevent the estate of the surviving spouse from having to pay estate tax. The standard in estate tax planning was to split an estate that was over the prevailing state or federal exemption amount between spouses and for each spouse to execute a trust to ...

The decedent's will specifically provided that the IRA was to pass to a trust for the benefit of the decedent's spouse during his life (Trust 1). Upon the death of the decedent's spouse, the assets of Trust 1 were to pass to another trust (Trust 2) of which the children were the beneficiaries.

Credit shelter trust diagram.

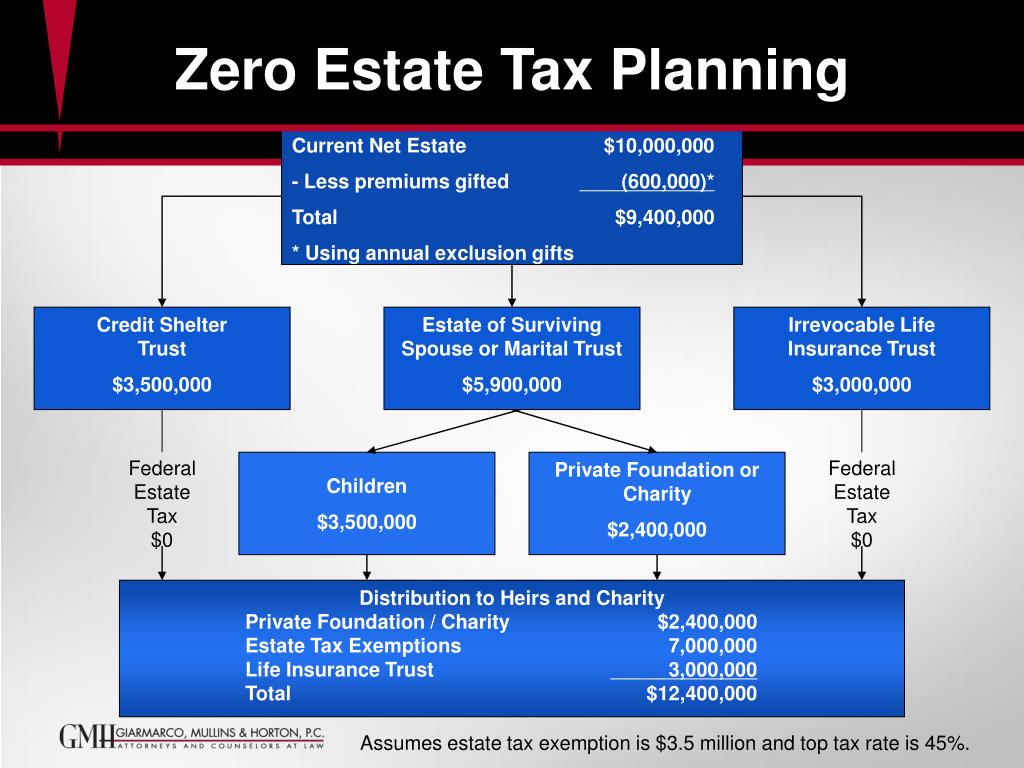

Understanding Credit Shelter Trusts: QTIP Trust vs Marital Gift Trust Estate planning offers individuals with significant assets the opportunity to reduce or eliminate the taxable value of their estate, while at the same time providing financially for their family, friends and important charities. Credit shelter trusts are becoming increasingly popular as an estate planning tool. […]

The Credit Shelter Trust allows a married couple to leave an estate worth up to $1.3 million without owing taxes. In this hypothetical situation, the couple saved $200,000 through a Credit Shelter Trust. ... Diagrams. Flowchart Software; Floor Plan Designer; Organizational Chart Templates;

The AB Trust system can be set up under the couples' Last Will and Testaments or Revocable Living Trusts. The "A Trust" is also commonly referred to as the "Marital Trust," "QTIP Trust," or "Marital Deduction Trust." The "B Trust" is also commonly referred to as the "Bypass Trust," "Credit Shelter Trust," or "Family Trust."

These credit shelter trusts work by channeling the assets into a trust for beneficiaries, such as the couple's children or other family members. Either type of trust may be a useful component of your estate plan, ... basis for trust to be funded, otherwise the benefit of the trust structure lost o Allows greater flexibility than formula trust

A credit shelter trust (CST), also known as a family trust or bypass trust, often plays an integral role in married couples' estate plans. At the death of the first spouse, an amount equal to the applicable exclusion amount (formerly the unified credit amount) is typically

A credit shelter trust is a type of trust fund that allows married couples to reduce estate taxes by taking full advantage of state and federal estate tax exemptions. As such, it's generally only applicable in cases of multimillion-dollar estates.

A Credit Shelter Trust aka is an Irrevocable Trust designed to hold an amount that can be sheltered from death taxes. Call us for a free consultation ,, Δ. Client Review "I worked for Peter Klenk for 4 wonderful years. I can’t speak highly enough of everyone at the firm. Everyone truly cares about their clients and has a strong sense of ...

Text in this Example: Spouse leaves everything to surviving spouse Spouse leaves his or her half of estate in a credit shelter trust $4 million estate $4 million for surviving spouse $2.835 million for children $1.5 million credit shelter trust $2.5 million $3.54 million for children No tax at first spouse's death Tax at surviving spouse's death = $1.135 million At surviving spouse's death ...

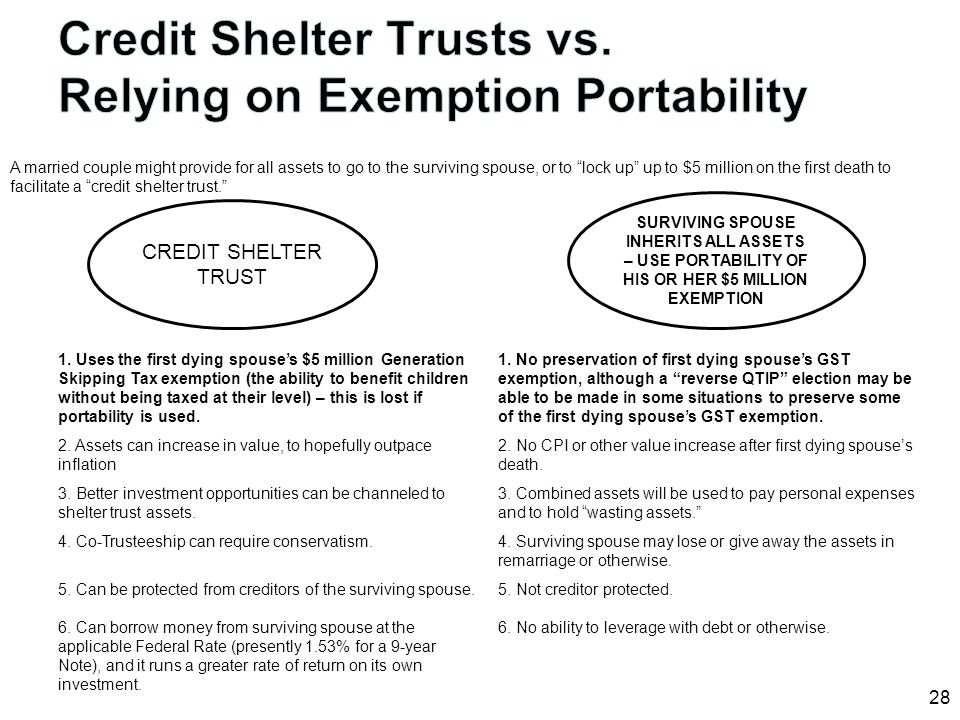

The way to preserve both spouses' exemptions has been to create a "credit shelter trust" (also called an A/B or bypass trust). Many states have an estate or inheritance tax and the thresholds are usually far lower than the current federal one. Let's say that a couple lives in State X, which has retained an estate tax on all estates over ...

The Setting Every Community Up for Retirement Enhancement Act of 2019 (SECURE Act) slams shut a valuable income-tax benefit for most inherited IRAs. A clear result of the SECURE Act is that the "stretch" inherited IRA is now unavailable for most beneficiaries other than a surviving spouse, and a 10-year payout is the new norm. The adage is that "where one door closes, another opens ...

Marital and Credit Shelter Trust; Schedule A; These documents are from the publication Estate Planning Forms. Gain instant access to convenient forms, letters, checklists, and agreements developed specifically with the Solo/Small Firm Practitioner in mind. Written by some of the top legal professionals in their field, our Forms Library is ...

The trust assets are counted as part of the gross estate of the surviving spouse and taxes must be paid if it is valued over the exemption limit. ... you can open a credit shelter trust in conjunction with the QTIP trust. Protection from a second spouse. A QTIP trust can be a useful part of an estate plan for a blended family. For example, if ...

1 CREDIT SHELTER/QTIP TRUST ^ REVOCABLE TRUST AGREEMENT THIS TRUST AGREEMENT, made and entered into this ^day of ^, by and between ^ of the Town of ^, County of ^ and State of Connecticut (hereinafter referred to as Settlor), and ^ of the Town of ^, County of ^ and State of Connecticut, (hereinafter referred to as Trustee), whereby the

Knowledge is Power and I will share my extensive legal and tax law knowledge with you when you have me partner with you. Call my office to schedule an appointment with me, Los Angeles Tax Lawyer, Kien C. Tiet, Esq. My offices are open 9 am - 5 pm, Monday through Friday. Call (626) 448-2282.

A credit shelter trust allows a surviving spouse to pass on assets to their children, free of estate tax. more. Why the Generation-Skipping Transfer Tax Won't Hurt You (Probably)

SLATs can (and often should) incorporate a trust protector who can remove and replace the institutional trustee if such trustee fails to perform as desired. 11 SLAT Benefits -Capital Gains SLATs reduce/avoid capital gains on the grantor's death. Under current law, if the trust holds appreciated assets, the settlor could swap

Jun 24, 2021 · Bypass Trust: An estate-planning device used to pass down assets after death without subjecting them to the estate tax. A bypass trust is a type of irrevocable trust and is most commonly used to ...

credit shelter trust or an irrevocable trust?" "When should a child who is also a ... Settlor as a Trustee of a Discretionary Trust The following diagram depicts the settlor as the trustee of a common law discretionary trust that is not limited by an ascertainable standard.

A credit shelter trust is the perfect instrument to ensure a legally married couple passes their full estate tax exemptions on to heirs. Know, however, that this trust is revocable and will not offer any additional tax advantages beyond ensuring two full exemptions. For greater tax efficiency, an irrevocable trust may be more appropriate.

The gross estate tax on the applicable exclusion amount is equal to the unified credit of $2,141,800, resulting in no net estate tax liability. When B dies, B's estate tax base would be $12,612,000, calculated as shown in the table "B's Net Estate Tax Liability With Marital Trust." B's net estate tax liability with marital trust.

A Bypass Trust is the name of the Trust by the deceased spouse, it is sometimes also known as a Family Trust or Credit Shelter Trust. What are the Pros and Cons of AB Trusts? AB Trust Estate Planning can be most beneficial for couples who live in a state without a portability for exemptions.

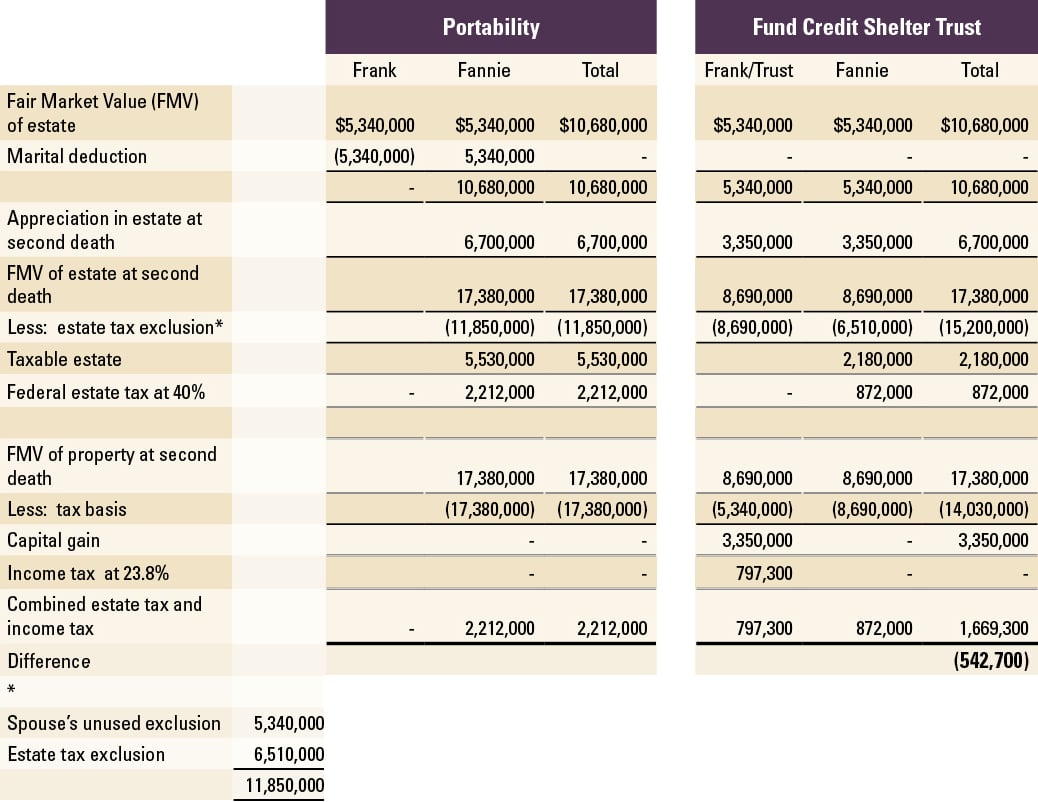

The gold standard for estate planning has been the credit shelter trust, often called a Family Trust. With each spouse being able to pass $5 million adjusted for inflation ($5.49 million in 2017) and with federal portability without a sunset provision, questions have arisen as to whether credit shelter trust planning is still necessary or ...

The marital disclaimer trust is similar to a credit shelter trust (CST): Assets placed in the trust are generally held apart from the estate of the surviving spouse, so that the assets may pass tax-free to the remaining beneficiaries when the surviving spouse dies. However, unlike most CSTs, the use of a marital disclaimer trust is optional ...

The same Credit Shelter Trust which preserves the estate exemption of the first spouse to die can also be used to preserve the first spouse's GST exemption. Couples can therefore collectively put over $10 million into a trust or trusts that last for multiple generations (limited by the rule against perpetuities), free of estate ...

But if desired, a credit shelter trust can be established in addition to the QTIP trust. Protection from family members or a second spouse. A QTIP can work great when there is a blended family. For example, if a surviving spouse gets remarried, the assets will not ultimately go to the surviving spouse and the new spouse. ...

State Death Tax Gap and Use of ABC Trust Planning . Using the same facts above, what would happen if Joe and Mary lived in Oregon, which collects a separate state estate tax in addition to the federal estate tax and only offers a $1 million state exemption? Upon Joe's death $5.25 million should go into the B Trust and $1 million should go into the A Trust, but because the amount being funded ...

• Disclaimer Funding of Credit Shelter Trust • Sample Will with Marital and Credit Shelter Trusts • Defining the Credit Shelter Trust- Federal or NYS Exemption • Pecuniary v. Fractional Funding (0.5 MCLE Credits – Skills) 1:45 p.m. – 3:00 p.m. Grantor Trusts and Life Insurance Trusts • Grantor Trust Rules - Estate and Income Tax

0 Response to "40 credit shelter trust diagram"

Post a Comment