37 private equity fund structure diagram

Download scientific diagram | 1-Private Equity Fund Structure from publication: The Patterns of Private Equity Investment in Ireland, 2007 - 2014 | Abstract Over the last decade developments of ... 32 Private Equity Fund Structure Diagram - Free Wiring Diagram Source. Taxation of private equity and hedge funds - Wikipedia. Fund Structure of Private Equity and Venture Capitalists - FinanciaL ...

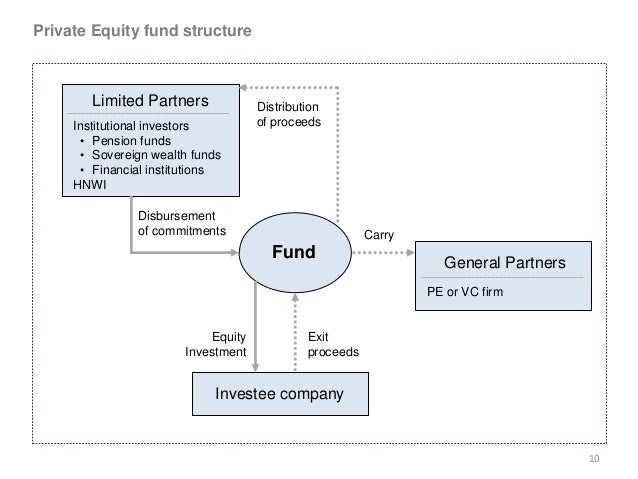

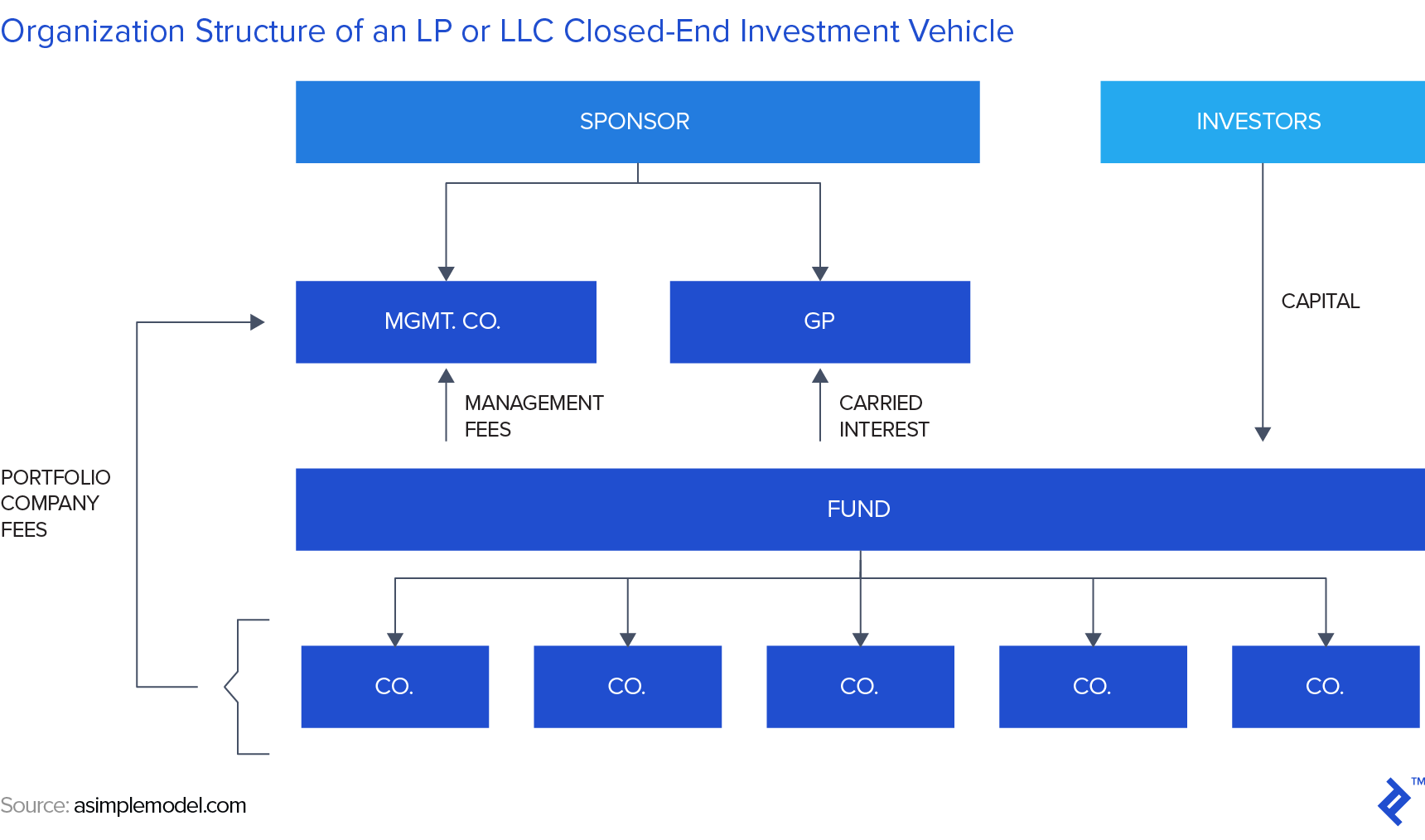

Most private equity funds are specifically designed to wind-down and terminate over a period of time. Advanced Limited Partnership Structure Funds pay a management fee and profit share (known as "carried interest" or "carry") to the GP for the management of the fund.

Private equity fund structure diagram

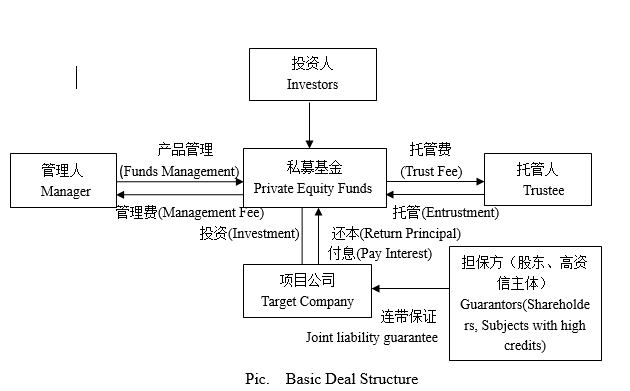

The type of private equity fund structure can impact how the accounting information for each investment and that of the company as a whole are recorded. The level of analysis the private equity ... Private Investment Funds Practice attorney. About Morgan Lewis's Private Investment Funds Practice Morgan Lewis has one of the nation's largest private investment fund practices and is consistently ranked as the "#1Most Active Law Firm" globally based on the number of funds worked on for limited partners by Dow Jones Private Equity Analyst. Private Equity Fund structure - Trust. A Private Equity that is structured as a Unit Trust is a type of collective investment governed by a trust deed. The investors are usually the main beneficiaries of the Trust. The Fund's Net Asset Value (NAV) divided by the number of units outstanding determines the price of each unit of the Trust.

Private equity fund structure diagram. Fund Structure found in: Sample Of Fund Structure Diagram Ppt Presentation, Private Equity Fund Structure Ppt PowerPoint Presentation Ideas Demonstration Cpb, Business Diagram Fund Of Fund Structure PowerPoint Ppt Presentation,.. Diagram of the structure of a generic private-equity fund A private-equity firm is an investment management company that provides financial backing and makes investments in the private equity of startup or operating companies through a variety of loosely affiliated investment strategies including leveraged buyout , venture capital , and growth ... This practice note provides an overview of the basic structure of a typical private equity fund, highlights some differences between English and Luxembourg ...22 pages Jun 9, 2020 — I. Introduction to Basic Entity Private Fund Structures ... conferences and more Partners Group Private Equity Master Fund is down -7.3% for ...11 pages

A private-equity fund is a collective investment scheme used for making investments in various equity (and to a lesser extent debt) securities according to one of the investment strategies associated with private equity.Private equity funds are typically limited partnerships with a fixed term of 10 years (often with annual extensions). At inception, institutional investors make an unfunded ... Professional academic writers. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines. This lets us find the most appropriate writer for any type of assignment. Vista Equity Fund II invested $50 million in Aspect in January of 2003 in exchange for convertible preferred stock representing an approximately 30% stake in the Company. Concerto Software acquired Aspect in September of 2005 for $11.60 per share, with a transaction value of approximately $1.0 billion. Private Equity Fund Structure Peter Lynch Private equity funds are closed-end investment vehicles, which means that there is a limited window to raise funds and once this window has expired no further funds can be raised.

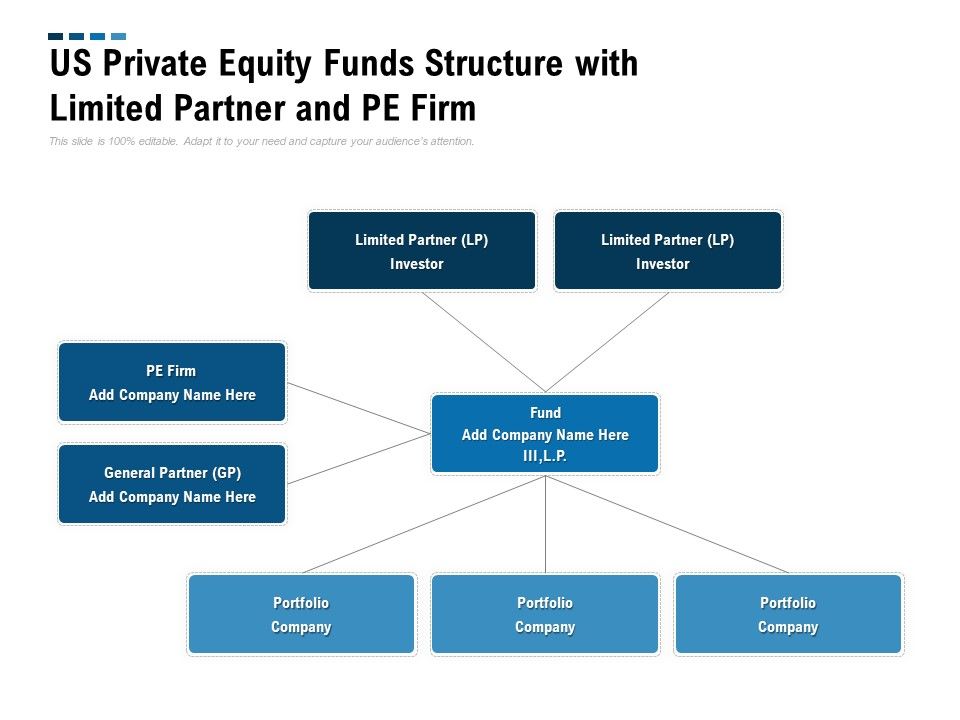

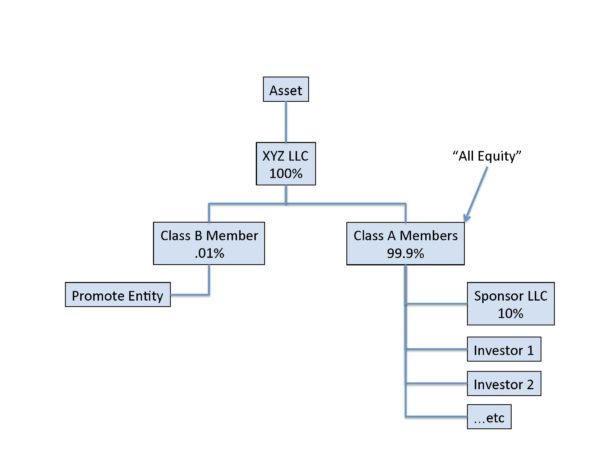

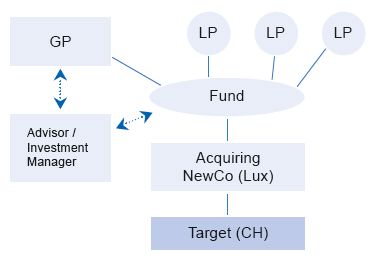

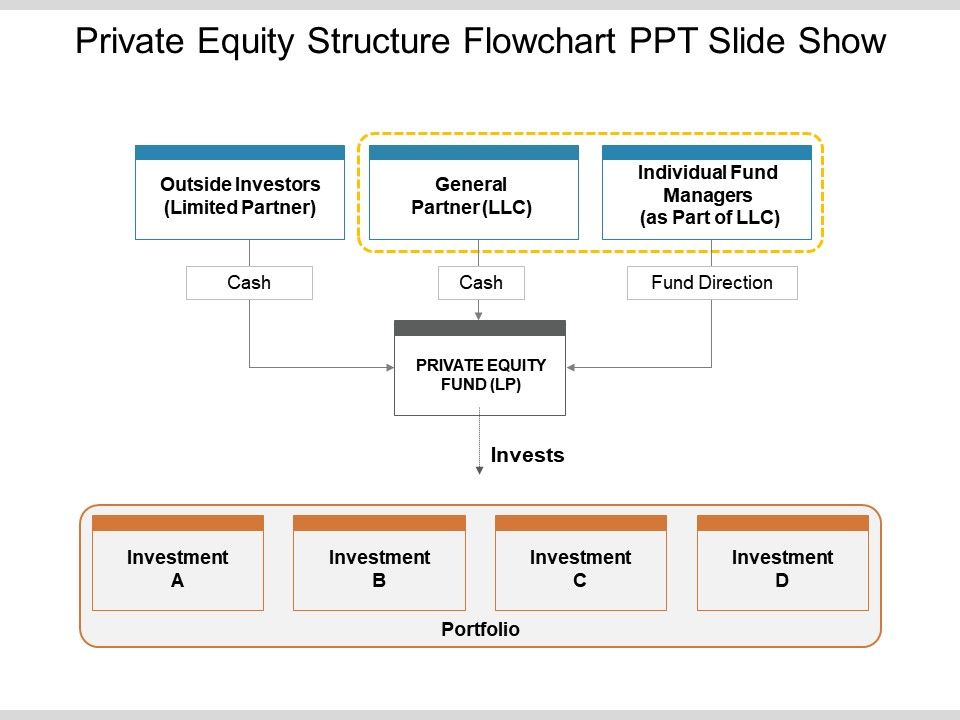

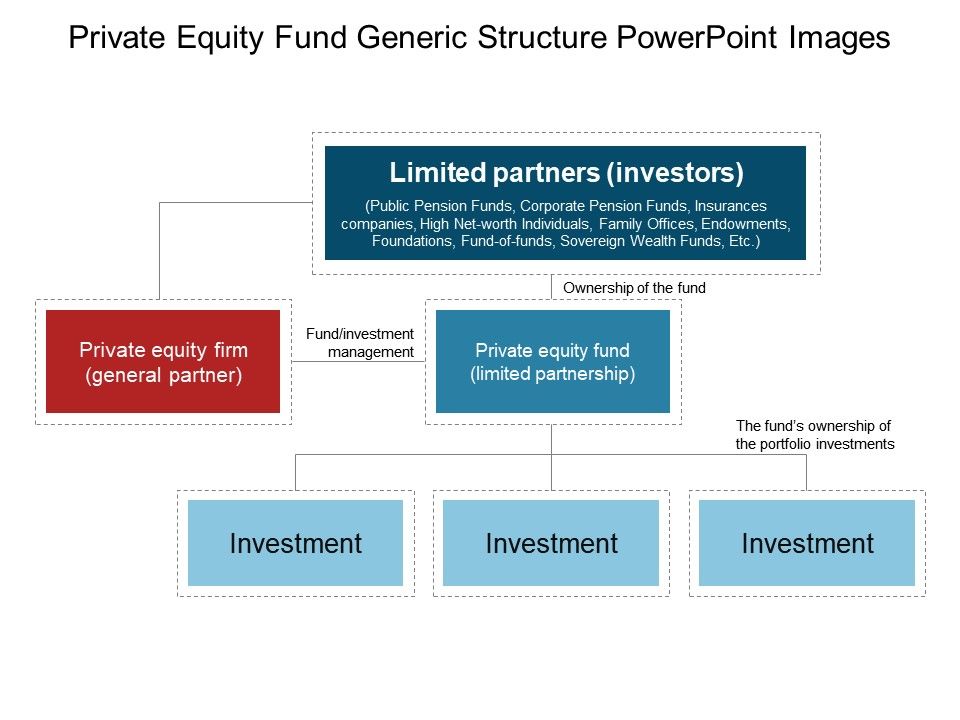

Private Equity Fund Structure. Peter Lynch ; Private equity funds are closed-end investment vehicles, which means that there is a limited window to raise funds and once this window has expired no further funds can be raised. These funds are generally formed as either a Limited Partnership ("LP") or Limited Liability Company ("LLC"). Most venture and private equity funds use a limited partnership as their legal structure (Figure 2), which involves two main types of actors: (1) a general partner (GP) and (2) limited partners (LPs). 05/04/2021 · Below is a simplified diagram of the steps involved in completing an F Reorganization with an S corporation. Pre-transaction Structure. Individual shareholders own all of the issued and outstanding equity of the existing corporation (“OldCo”). Step 1: Formation of new corporation (“NewCo”). 11/04/2018 · The Equity Capital Markets Team Structure: 3 or 4 Teams in 1. Most people speak about ECM as if it’s a single group, but it is actually divided into a few different subgroups at most banks: Equity Origination: This team pitches companies on raising capital and then executes financing deals such as IPOs and follow-on offerings.

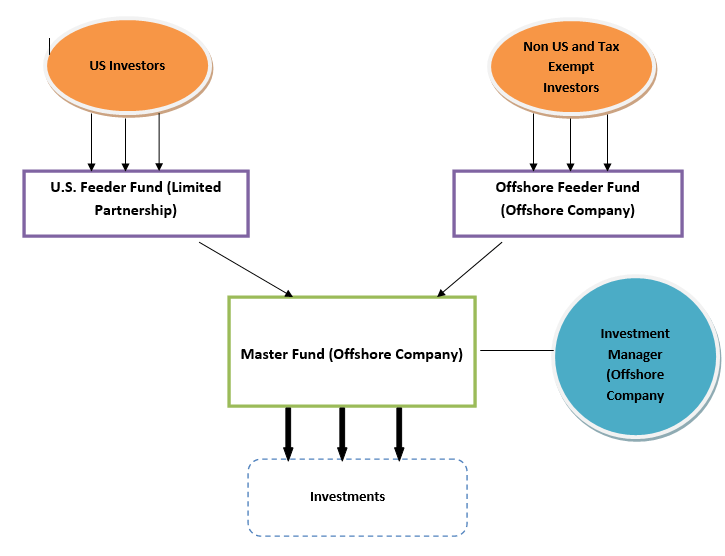

What is a Master-Feeder Structure? A master-feeder structure is an investment structure used by hedge funds Hedge Fund A hedge fund, an alternative investment vehicle, is a partnership where investors (accredited investors or institutional investors) pool under which multiple investors invest in onshore and offshore “feeder” funds, which, in turn, invest in a larger “master” fund.

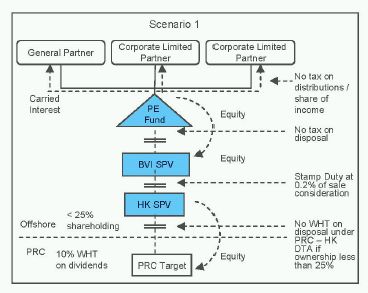

Fund Blocker Corporation Structures Where a private equity fund invests in a flow-through portfolio company engaged in a U.S. business (i.e., a portfolio company organized as a partnership or LLC), certain tax-sensitive fund LPs — virtually all non-U.S. LPs and many U.S. tax-exempt LPs —

advising private equity, growth equity, and venture capital funds and their portfolio companies in a wide variety of transactions including leveraged buyouts, recapitalizations, M&A, and growth-equity financings. A blocker corporation is sometimes used by a PE or VC fund to invest in an LLC or partnership. Goodwin Procter's John LeClaire and ...

As engineers of some of the earliest innovative instruments being used by investment funds (both private equity and venture capital) in India we proactively spend time in developing an advanced under-standing of the industry as well as the current legal, regulatory and tax regime. Choice of Fund Vehicle Structure follows strategy, and not vice ...

3 A good description of real estate private equity fund structure can be found in Andrae Kuzmicki and Daniel Simunac, "Private Equity Real Estate Funds: An Institutional Perspective," Real Property Association of Canada, 2008.

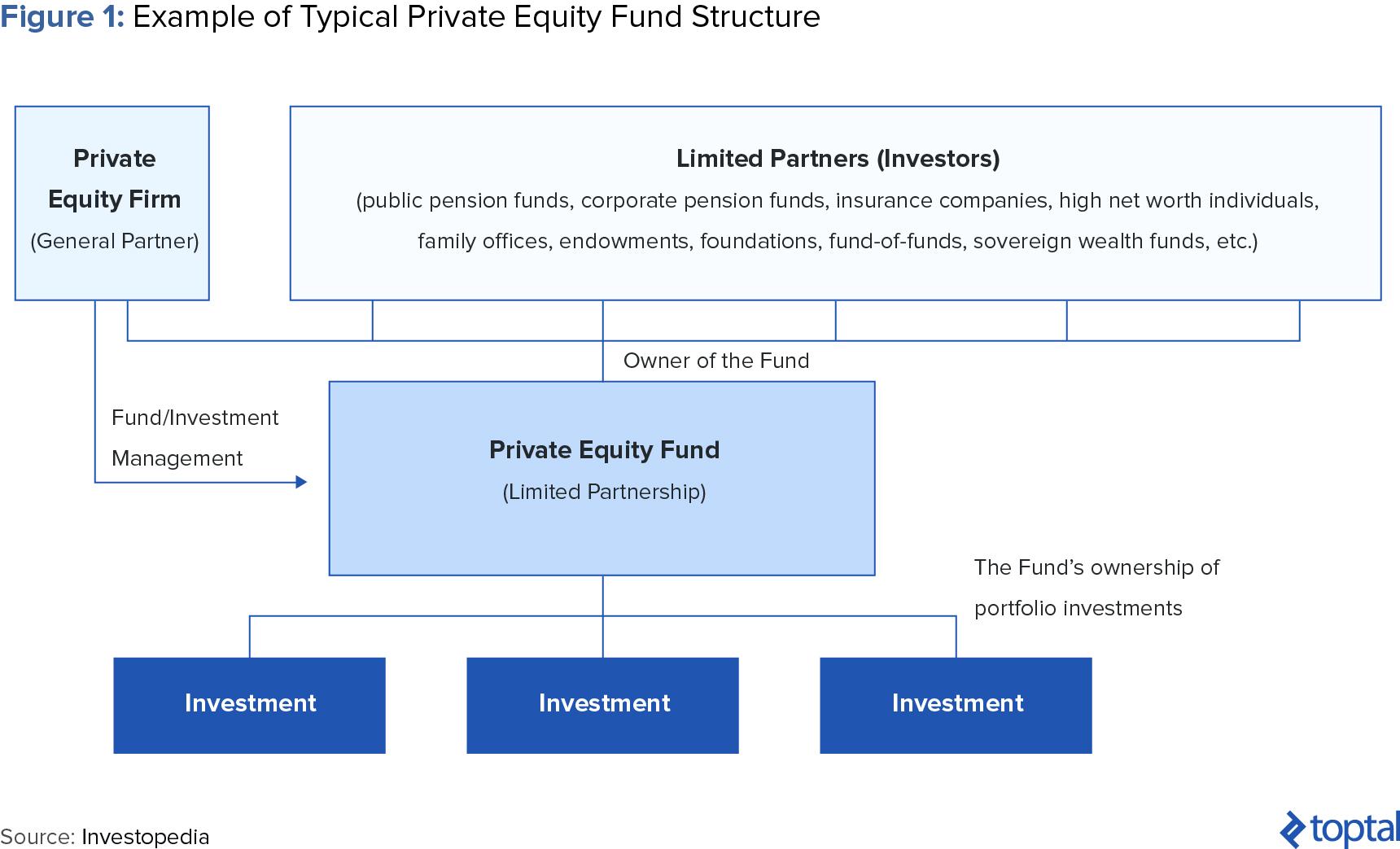

The structure of a private equity fund generally involves several key entities, as follows: "!The investment fund, which is a pure pool of capital with no direct operations. Investors acquire interests in the investment fund, which makes the actual investments for their benefit (see

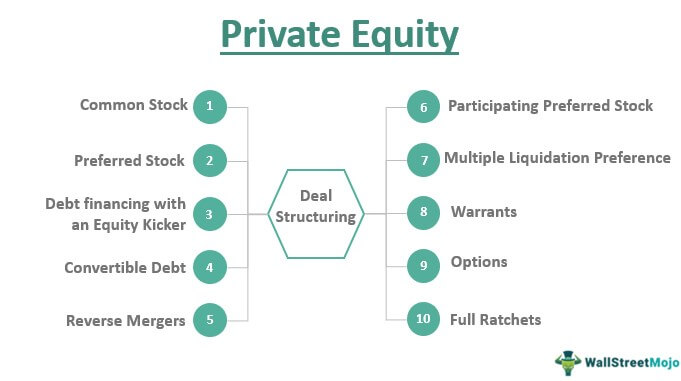

1. 'Sourcing' and 'Teasers' The beginning of the private equity deal structure is called 'deal sourcing.'Sourcing involves discovering and assessing an investment opportunity. PE deals are sourced through various methods such as research, internal analysis, networking, cold-calling executives of target companies, business meetings, screening for certain criteria, conferences and ...

The goal of a private equity investment structure is to align the interests of the various parties who invest in an individual deal or a private equity fund. Private equity waterfalls can take different forms based on each party’s goals as well as ensuring the other stakeholder has the correct incentives in the investment along with the other ...

Structure of the Hedge Fund Master – Feeder. The structure of a hedge fund shows the way it operates. The most famous format is a Master-Feeder one, which is commonly used to accumulate funds raised from both U.S. taxable, U.S. Tax-exempt (Gratuity funds, Pension funds), and Non – U.S. investors into one central vehicle.

A. Plain vanilla fund structure PlainVanillaFund Offshore Investment Investors Investment management Type9SFClicencerequired (iffundmanagement functioninHong Kong) 3 Offshore Fund (incorporated as a ... Advised a European fund manager on private equity investment in an offshore holding

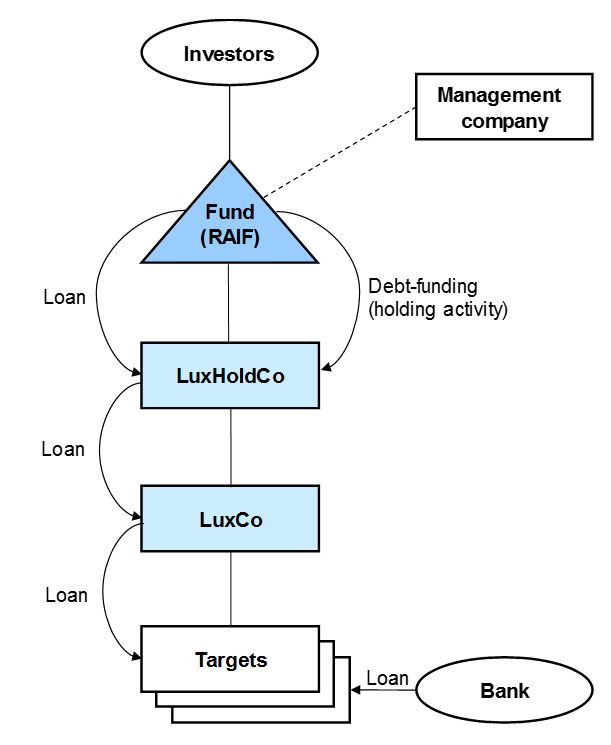

In view of this, we decided that the private equity fund model was most suitable. Furthermore, we decided to structure the vehicle as a fund-of-private-equity-funds (see diagram above), i.e. a vehicle that invests primarily in private equity funds. Fund-of-funds are well-established in the marketplace and have the benefit of being inherently ...

Private equity funds are closed-end funds that are considered an alternative investment class. Because they are private, their capital is not listed on a public ...Private Equity Fund Basics · Fees · Limited Partnership Agreement

Equity & Venture Capital Association (BVCA) "model" partnership carried interest structure and route the carry through a separate limited partnership interest (owned by the Carried Interest Partner). www.duanemorris.com ... Private Equity Fund Distribution Waterfalls .

Diagram of the structure of a generic private-equity fund Although the capital for private equity originally came from individual investors or corporations, in the 1970s, private equity became an asset class in which various institutional investors allocated capital in the hopes of achieving risk-adjusted returns that exceed those possible in ...

Please note: This is a simplified illustration and explanation of three structures that can be used for investment funds. These diagrams do not illustrate all of the entities involved in forming, operating, or managing a fund. This diagram does not provide a definitive illustration of any particular fund structure, any guidance on,

Private Equity and Hedge Fund Structure • Capital can be raised from both U.S. and overseas accredited individuals and/or institutional investors. Therefore, a typical fund may have a general partner as well as U.S. limited partners and non-U.S. limited partners.

Private equity funds are closed-end investment vehicles, which means that there is a limited window to raise funds and once this window has expired no ...Jan 17, 2017 · Uploaded by A Simple Model

Private equity firms, mutual fund companies, life insurance companies, unit trusts, hedge fund companies, and pension fund entities are examples of buy-side firms. read more) and showcasing their calls on the stocks. They have to diligently communicate buy sell recommendations of stocks.

To understand how private equity firms are structured, it's important to understand that the partners of a private equity firm comprise the "General Partner" (GP) of a fund.They obtain capital commitments from (typically) institutional investors known as Limited Partners (LPs). These institutional investors include pension and endowment funds, retirement funds, insurance companies, and ...

A general partner General Partner A general partner (GP) refers to the private equity firm responsible for managing a private equity fund. The private equity firm acts as a GP, and the external investors are limited partners (LPs). read more contributes 1-3% of the total investment and handles the fund's management as a manager.

Private equity firms are structured as partnerships with one gp making the investments and several lps investing capital. 01162017 private equity fund structure. The structure of a private equity fund generally involves several key entities as follows. A private equity firm is a group that collects investment funds from wealthy individuals or ...

Private Equity Transaction Timeline. There are various steps involved in a Private Equity Transaction Timeline. The diagram below shows the different steps in a M&A Mergers Acquisitions M&A Process This guide takes you through all the steps in the M&A process. Learn how mergers and acquisitions and deals are completed.

Private Equity Fund structure - Trust. A Private Equity that is structured as a Unit Trust is a type of collective investment governed by a trust deed. The investors are usually the main beneficiaries of the Trust. The Fund's Net Asset Value (NAV) divided by the number of units outstanding determines the price of each unit of the Trust.

Private Investment Funds Practice attorney. About Morgan Lewis's Private Investment Funds Practice Morgan Lewis has one of the nation's largest private investment fund practices and is consistently ranked as the "#1Most Active Law Firm" globally based on the number of funds worked on for limited partners by Dow Jones Private Equity Analyst.

The type of private equity fund structure can impact how the accounting information for each investment and that of the company as a whole are recorded. The level of analysis the private equity ...

0 Response to "37 private equity fund structure diagram"

Post a Comment